|

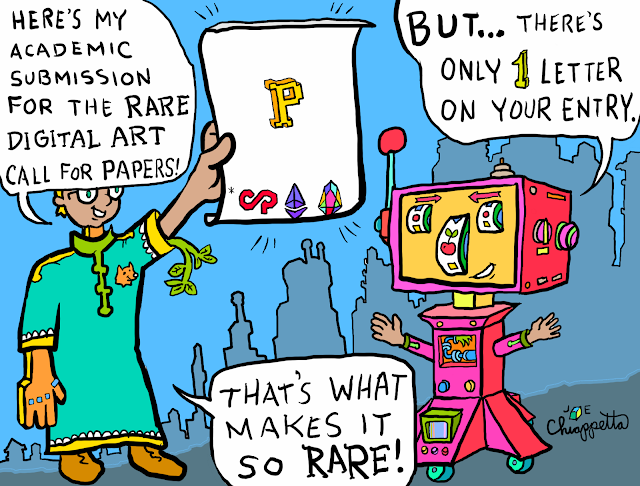

| Rare Paper by Joe Chiappetta is available as rare digital art on MakersPlace. |

While my comics can delve into the silly side of things, it might surprise a few folks to know that I am a deep thinker. Lately I have deliberated on what would be useful for artists and collectors to know about innovations in the art and blockchain space. Twelve considerations come to mind, and they all trace their roots back to a little digital creation called Bitcoin.

The fact that Bitcoin has been coded to exist in only 21 million units is highly relevant to artists and art collectors. Perhaps this is even more relevant than many in the art industry currently perceive. With Bitcoin came the advent of limited-supply cryptocurrency issuance; digital art tied to such currency is now able to be released in a limited supply as well.

Therefore, for the first time, a scarcity market can be imposed (or coded) into digital art, making it collectible. Ownership and rarity are verified on the blockchain. This ecosystem produces what we call "rare digital art." It is a movement that has grown by leaps and bounds since its inception a few years ago.

Nevertheless, there are facts about rare digital art that the buyer and seller must understand under the current technical structures in which it exists. What a person actually owns when they buy rare digital art is actually not the art. What they own--as in what can be traded--is a unique digital token on a blockchain. Such a token is often called a non-fungible token (NFT). Non-fungible means "unique." So that particular unique token is linked to a specific artwork. Therefore it is most accurate to say that the cryptographic token is what you own; the art represents the token's image.

Despite the above technical parameters, rare digital art still has widespread implications, including industry-disrupting innovations. It lands under the subcategory of Art as well as the subcategory of Cryptocurrency. As with anything new, it can be helpful to provide guidelines for rare digital artists and collectors joining in on this exciting game-changer in the art and finance ecosystems.

The following 12 recommendations and considerations are designed to shepherd artists and collectors through this revolutionary field that is rare digital art. I will list them as a quick overview and then go into more detail below.

- How To Choose A Good Blockchain For Rare Digital Art

- Operate On At Least 2 Blockchains

- Which Rare Digital Art Market Should You Operate On?

- Pricing Rare Digital Art With Variety

- How Many Rare Digital Art Editions Should Be Released?

- Artists Become Collectors

- Collectors Become Artists

- Buy Art That Includes The Artist's Signature

- Tell The Backstory

- Promote Your Art

- Beef Up Online Security

- Remember To Have Fun

|

| The Mind Pour by Joe Chiappetta is available as rare digital art on MakersPlace. |

12 Tips for Artists & Collectors of Rare Digital Art

1. How To Choose A Good Blockchain For Rare Digital Art

More blockchains and cryptocurrencies are created each quarter. Therefore spend a few months doing your own research first. As blockchains for rare digital art go, Counterparty (which runs on top of Bitcoin) and then Ethereum have the longest track record of operating in this space. EOS, with pixEOS running on top of it, is well-positioned to become a serious contender, with many others vying for a top spot.

So which blockchain is best for rare digital art? I see Counterparty, Ethereum, and EOS/pixEOS as each having unique traits that others do not have. If only the 3 of them could merge into one super-chain. But that's not current reality. Here is a summary of where these blockchains are at right now:

- Counterparty is old-school respected as a rare digital art pioneer, running on top of Bitcoin, yet with a smaller user base, and therefore lower in funding/development resources.

- Ethereum has the most rare digital art markets, widely adopted, well funded, (usually) decent public image, yet slow to upgrade to faster transaction times.

- EOS has fast transaction times, no user transaction fees, a large user base, yet still in the process of perfecting how to manage/govern their global blockchain fairly.

With these assessments in mind, here are some further questions to consider when asking what to look for in a blockchain for rare digital art?

- What is the measurable value of this blockchain? Market capitalization data can help to determine this. In other words, how many units of this cryptocurrency exist, multiplied by the current price of one unit?

- How many daily users does the blockchain have?

- Is this blockchain easy to use?

- How fast are the transactions?

- What are the fees to issue art on that blockchain?

- What other use cases does this cryptocurrency have?

- Is it a global, well-distributed blockchain, or is it just one or two computers running the whole network?

- Who is on the team leading development and upkeep of this blockchain?

- Can you really see this blockchain thriving in 5 years... 10 years... and beyond?

- How long has the blockchain been used already to trade rare digital art?

2. Operate On At Least 2 Blockchains

Cryptocurrency is still new technology, somewhat unregulated, volatile in pricing structure, and the competition to be a stable and desirable blockchain is fierce. Therefore, as time permits, create and collect art on at least 2 different blockchains. Then all your eggs will not be in 1 basket.

3. Which Rare Digital Art Market Should You Operate On?

Unless you create your own blockchain or marketplace, you will need to release/collect art on an existing rare digital art marketplace. There are many sites out there to do this, but not all will survive the test of time. Once you narrow down which blockchain(s) you prefer, then select a marketplace site (or two) with these considerations in mind.

- How well does this marketplace promote itself and its artists?

- What is the onboarding process for new artists?

- How easy is it to list new high resolution art for sale?

- Can collectors easily resell rare digital art they own?

- Are the digital art images hosted in secure locations?

- What art data actually ends up on the blockchain?

- How does the site fund its operations?

- What percentage of each sale do I get?

- Do artists receive resale royalties on all secondary sales?

- Is it likely that this particular market/online gallery will still be here in a few years?

- Is a collector's collection available for viewing under one public Internet address?

- Do you like viewing your art on this platform?

- Are other artists on this marketplace allowed to put the whole site at risk by uploading illegal content?

- How big is the community for this marketplace?

- Is their community full of people you want to interact with?

- What is the site's strategy to onboard people new to cryptocurrency?

- Does the site contain affordable art, or are too many items overpriced?

- Is the team running the site wise and professional?

- Do artists and collectors get access to their platform metrics (page views, sales data, etc.)?

Cryptosketches and Cryptographics are two very unique rare digital art markets whose innovation-levels are still forces to be reckoned with. However they appear to be proof-of-concept markets that may not receive further upgrades. Naturally, there are other sites I have heard good things about. However, I have no experience using them so I will stick only to what I know.

4. Pricing Rare Digital Art With Variety

Diversification is the key here. Your body of work should have a variety of pricing options, regardless of how well known you are. This includes some art with a fixed price, and some that is up for auction. This will help to capture collectors of all income levels, all spending preferences, and keep you from been seen as an inaccessible star.Auctions:

Some of your work should not have a fixed price on it; rather it should be up for auction. Let people bid on it and price discovery will be market-driven. If the bids are not as high as you'd like, you are not under any obligation to accept such bids. No bids may also be a sign that you need to market your work more effectively.

The auction option is appealing on a number of levels. It's for people who have a bargain hunting mentality. It's for patient collectors hoping you'll accept their price if no one else is bidding on your work. Where the auction option becomes an extra boost to the artist is when multiple collectors start bidding on your work, driving the price higher than imagined.

Fixed Pricing:

Give a high price only to work that meets all 4 of these points:

- It is one of your very best pieces... like in your top 10 of all time.

- It took you more than 3 hours to create.

- It is an edition of only 1.

- You can reasonably imagine another person actually paying a high price for this digital item even though what the buyer is actually getting is ownership of unique cryptographic token.

Set low prices on pieces that you want a lot of people to collect. Imagine you just released a pack of stickers or collectible cards and you want many people to enjoy them.

5. How Many Rare Digital Art Editions Should Be Released?

This depends largely upon a few factors:

- How many people at a time do you want to be owners of this work? If you want a lot of people to own it, then price it low. If you want only 1 owner at a time, then the price should be higher since it is a more scarce edition of only 1.

- Do you want to keep 1 edition for yourself too?

- Do you want to give a few away as promotional freebies?

- Is selling high volume a priority? Then price lower and release more per edition.

- For those considering releasing in editions of more than 10, first ask yourself, "Are there really more than 10 people who will spend money on this non-material digital item I created?"

6. Artists Become Collectors

You will think clearer and with a bigger market vision in mind when you step into the shoes of your counterpart. Being a collector and an artist for decades, I frequently ask myself a few questions:

- Would another person actually pay money for this thing I am creating?

- How much would I pay to have this in my collection?

- How original is this creation?

- If I want to resell this to other collectors, would buyers be attracted to it?

- Would I want this in my collection even if it does not increase in monetary value?

7. Collectors Become Artists

Similar to the previous point, collectors will benefit from issuing their own original art on a platform they are thinking of buying art on because they will discover firsthand how well the ecosystem works with less risk to themselves. Even for collectors who do not consider themselves artists at all, they could still issue one good photograph that they took themselves. It might even lead to some surprise sales.

As an artist/collector, out of gratitude and curiosity, I typically look at the account of who bought my work. If I see anything in their collection that I want, I would happily make an offer on it. Moreover, a collector who issues their own art too has more trading leverage. An artist/collector can always trade their own art for another artist's work and thus minimize collecting expenses.

8. Buy Art That Includes The Artist's Signature

In a digital age, copying and pasting is easy. So art that is issued with the artist's signature incorporated into the art is somewhat less likely to be falsely attributed to another creator. Yes, the blockchain can record all this, but not everyone will go and explore the blockchain. Therefore keep an eye out for signed artwork.

In fact, as a collector, the artist's signature is one of the things I often look for when deciding to make the purchase or not. Mind you, I am not saying signatures must be mandatory. Indeed, on occasion I have bought art without signatures because it was clear that the art was from the ascribed artist since I follow them on social media. Yet a signature is useful when I have no context or relationship with the artist and I just want to make sure I am buying work properly attributed in the actual image.

In fact, as a collector, the artist's signature is one of the things I often look for when deciding to make the purchase or not. Mind you, I am not saying signatures must be mandatory. Indeed, on occasion I have bought art without signatures because it was clear that the art was from the ascribed artist since I follow them on social media. Yet a signature is useful when I have no context or relationship with the artist and I just want to make sure I am buying work properly attributed in the actual image.

On the creator side of things, having my signature on my art is important also because people will copy art and share it in various places--often without my permission. Sometimes they credit me in captions, but sometimes they don't. So having my signature on the art (written large enough to be readable even on mobile devices) helps to establish who did what.

9. Tell The Backstory

Pay careful attention to the art description. Part of the appeal of art is not just the actual art, but also the story behind the art. Artists should succinctly tell the tale of how the art came about, and/or elaborate on what the themes are. This can be done in a few sentences or a few paragraphs if needed.

If the art looks good, and the price looks good, my final decision on whether or not I buy art comes down to what the artist says. In fact, if an artist says nothing about the art, I don't buy it. For me it is a red flag for 3 possible reasons:

- The art may not be theirs.

- The art is shallow.

- They are dropping art frantically all over the internet, desperate for a quick sale, and have no care to cultivate a professional relationships with their collectors or the community market that they participate in.

Moreover, collectors can, and should add to this story. They can publicize why they decided to collect the art. Such details add to the experiential nature of the art world, and increase the legend behind a particular piece of art.

10. Promote Your Art

Art typically does not sell itself. The art market is highly saturated with talented creators. So diligent marketing is needed if you want to make consistent sales. Regardless of whether you are an artist or collector, nothing increases awareness and potential value quite like artists, and especially collectors talking about their art, sharing it, telling the backstory of it, getting the art in exhibits, and being active in a few relevant communities.

11. Beef Up Online Security

Since cryptocurrency can be exchanged for local currency through certain providers, in addition to attracting sincere professionals, it also attracts thieves and scammers. Therefore creators and collectors in this space need to use best practices when it comes to online crypto-related security. This will take time researching the latest tips, and it will also take vigilance to put them into practice.

12. Remember To Have Fun

We are talking about art and the collectible cryptocurrencies tied to it. This is not brain surgery or bomb diffusion. So lighten up and have some fun. It's about participating in the art experience along with this crazy crypto-ecosystem that is international, fast (usually), entertaining, paradigm-shifting, full of potential economic opportunities, and pleasing to the eye of the beholder.

|

| Anniversary Dinner Date with My Wife by Joe Chiappetta is available as rare digital art on MakersPlace |

I hope these guidelines help you navigate the wonders of art linked to the blockchain. When diving into the deep and dynamic waters of rare digital art, you will do well to keep these elements in mind. As we shape this new frontier together, I also pray that you will enjoy the ride at least as much as I have!

Joe Chiappetta